More than five years have passed since the Chinese leader Xi Jinping announced the massive geo-economic plan that later took shape of Belt and Road Initiative (BRI). In CEE, the BRI came on the heels of the 16+1 cooperation mechanism, which was formed by China and the 16 CEE countries in 2012. Both projects brought high hopes for the new era of cooperation with China, brimming with economic benefits for the CEE countries. However, not just in the case of Slovakia, these hopes went unfulfilled. Despite the publicity given to BRI, the Slovak-China relationship has only seen more of the same.

Slovakia became one of the first EU countries to sign a MoU on cooperation with China on BRI in 2015. The vague MoU lists cooperation in five areas – policy coordination, infrastructure connectivity, trade, financial cooperation and people-to-people contacts and is almost identical to other bilateral MoU China has signed with other BRI countries. However, apart from this rough outline for cooperation, Slovakia and China have not reached an Action Plan that would sketch a more specific goals for two sides to achieve, unlike, for example, the Czech Republic. The progress in the key pragmatic fields of cooperation with China since announcement of BRI and Slovakia’s “accession” has been at best limited.

Trade remains unbalanced

In terms of the trade relationship, the value of bilateral trade has actually decreased since achieving the highest level in 2014. Yet, the value of trade does not pose the biggest problem to Slovakia, whose exports to China have actually been quite a success story in the region. Instead, the highly imbalanced structure of Slovak exports, almost ¾ of which are taken up by automobiles and automobile parts is the most serious issue. Taking into account Slovak participation in the Germany-centered value chains with final products often re-exported to China, this imbalance is most likely even more salient. Not counting the foreign-owned automobile producers, Slovakia’s export to China is minimal. This reflects the fact that Slovak SME’s exports to non-EU countries are the smallest among the EU countries. Slovak companies are generally not interested in breaking into the Chinese market. At the much heralded 2018 China International Import Expo, only two Slovak companies participated.

One possible remedy to the woes of Slovak export to China that has been put forward by the Slovak government is the export of agricultural products and quality food products to China. However, the issue of trade access remains an obstacle to Slovak exporters, despite China’s professed attention to solving this problem. Slovak products such as dairy and meat have to undergo a painstaking certification process, which in many cases has been dragging on for years. It has been clear that approving Slovak products for import has not been given priority by the relevant Chinese departments, despite the political declarations. At the same time, it is questionable if export of these products can overturn the reality of bilateral trade relationship. The potential export volume of Slovak exports is limited and other exporters already have established presence on the Chinese market. Last but not least, Slovakia is actually a net importer of food.

Investment marred with case of failure

In terms of investment, BRI has also not brought any significant upsurge in Chinese FDI. As of 2017, the total stock of Chinese FDI in Slovakia has reached only 45 million euro, accounting for mere 0,1 % of all FDI (National Bank of Slovakia data). It needs to be said that investment data are notoriously unreliable and investment is often conducted via a third country. That is also the case of the recent acquisition of a logistic park near Galanta by a Chinese company CNIC, which has been conducted through Hong Kong and Liechtenstein and will thus not show up in the bilateral FDI data. The acquisition reportedly tallied 100 million euro, which would make it the largest investment by a Chinese company so far. In fact, the investment has been presented by the CNIC and the Chinese Embassy as a part of the BRI, making it a sole BRI investment in Slovakia. Of course, it should be noted that this label appears to be applied rather liberally. Nevertheless, even counting this acquisition, the overall picture of Chinese investments in Slovakia remains very modest. Moreover, it exemplifies Chinese preference for M&A investments as opposed to green-field investments, which are still very limited in Slovakia. Overall, neither Slovakia, nor the CEE region overall, is a desired destination for Chinese FDI, which remains heavily concentrated in Western Europe.

The modest Chinese FDI stands in contrast with the several announced Chinese investments which have not materialized. Some earlier announced investment, such as the planned joint airline company or the “European China Center” went quiet after significant publicity. The CFEC plans for acquisition of a Slovak private TV station Markíza dissipated after the financial woes of the controversial company brought sudden stop to its ambitions in Slovakia and especially the neighboring Czech Republic. Other Chinese investments such as planned acquisition of the controlling stake in the biggest Slovak private employer U.S. Steel Kosice and the main Slovak power utility Slovenské Elektrárne failed as well – in the former case the US investor decided to retain its stake, in the latter, Chinese company was outbidded by a Czech investor.

Trains bypass Slovakia

The last key field of cooperation as envisaged by BRI is infrastructure. There has not been any case of China-funded infrastructure in Slovakia, before or after the announcement of BRI. The one case where Chinese participation was discussed was a project of a dam on river Ipeľ, but it has stumbled upon Slovak inability to provide sovereign guarantee for the project. The Chinese model of infrastructure “investment” based on high-interest loans buttressed by state guarantees and undertaken by Chinese companies is not applicable in Slovakia, which has ample means of more advantageous funding from other sources, especially EU structural funds. In terms of public tenders, these are still mostly a foreign concept for Chinese companies. Yet, recently we have seen Chinese companies unsuccessfully participate in public tenders for highway construction.

One part of infrastructure cooperation which merits particular attention is the area of transport, specifically cooperation on China-Europe Railway Express. In contrast to other areas of cooperation under BRI, direct link with the overall initiative is more discernible here. Rail transport between China and Europe has seen impressive growth over the past few years, providing a faster and cheaper alternative to sea and air transport (for a specific category of goods) respectively. The number of trains taking the China-Europe route has risen from mere 17 in 2011 to more than 6000 in 2018. Slovakia is located on the inter-Eurasian corridor and in the east of the country in Dobrá, there is one of the largest facilities for reloading from broad gauge to standard gauge railway in Europe, a necessary step for trains passing from China to Europe.

As the potential entrance point for Chinese goods to Europe, Slovakia could gain significant income from tariff collection and fees for using Slovak infrastructure. Moreover, Eastern Slovakia could serve as a hub for the transshipment of goods serving the whole region. The government has plans for a new logistic center in the eastern city of Košice and there has also been talks of involvement of Chinese capital (CCCC company, one of the most active companies under BRI). Lastly, the project of extension of the broad gauge railway throughout Slovakia to Austria has been discussed for a long time.

However, as in other cases, the potential has not translated to reality. So far, there has only been one trial direct train with destination in Slovakia that arrived from Dalian to Bratislava in November 2017. The train was to be made into a regular connection, but it has not gotten the needed subsidies from the local government in China. Despite plans to eventually process 50 % of the China-Europe rail transport traffic, only few trains have crossed through the Ukraine-Slovakia border. In 2018, the number has reached 97 trains out of more than 6300 China-Europe trains dispatched. The vast majority of trains go through Poland-Belarus border using the Malaszewicze-Brest terminal, despite the existing bottleneck. In the second half of 2018, trains stopped going through Ukraine altogether.

The chief inhibiting factor for achieving the potential of Slovakia in the railway transport has been the situation in Ukraine and relations between Kiev and Moscow. Transit through Ukraine has been stopped before in 2015 because of the Russian embargo on Ukrainian goods. The second cut-off in 2018 was caused by delays on transit through Ukraine. The ties between Russia and Ukraine have also hindered effective multilateral customs cooperation on the route. Because of the security situation in Ukraine, rail operators have been unwilling to risk transit through the country. While Slovakia is dependent on the Ukrainian route, China, Russia and other actors involved have diversified options. Furthermore even without the troubles in Ukraine, the Slovak route is a little known option for rail operators. The Chinese planning document for the development of China-Europe Railway Express does not even list Slovakia as sitting on the major route. With the uncertainties involved, potential projects of upgrading or building new infrastructure in eastern Slovakia do not have an optimistic chance of materialization. It is also unlikely Chinese companies would invest here facing significant risks that the facilities will be left unutilized.

Lack of interest

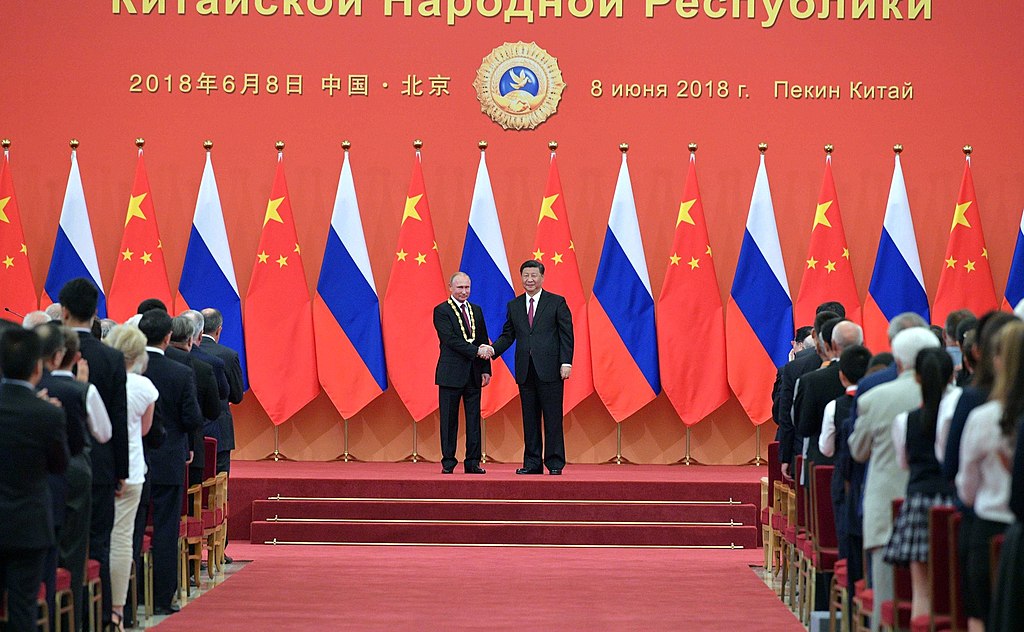

The lack of meaningful progress in bilateral relationship under the BRI attests to the fact that for China, Slovakia remains a country of peripheral importance in the region. As the only member of V4, Slovakia’s relationship with China has not been elevated to the level of strategic partnership. Slovakia has largely been avoided by Chinese political representatives which causes striking imbalance in bilateral visits. The Chinese embassy in Slovakia also remains rather passive in promoting BRI and China overall to Slovakia (for example, it does not have a Facebook page).

Slovakia itself remains ambivalent towards the prospect of cooperation with China. The former Prime Minister Fico once hailed the bilateral relationship as important for Slovak economy, but grew increasingly skeptical with the passage of time, famously saying that he wouldn’t visit China if nothing would come out of it. Fico’s successor Pellegrini also touted the potential of the bilateral economic relationship, but soon exhibited signs of disillusionment with Chinese inability to make progress in approving Slovak agricultural exports. In general, relationship with China has garnered very little interest among Slovak politicians, unlike in the Czech Republic or Hungary. The most debated China-related topic recently was Slovak President’s Kiska meeting with Dalai Lama in 2016 which was however used as a tool in the domestic political conflict. Due to Slovak government’s pro-EU policy, there has been no need to use China as a shield towards Brussels, which has clearly been the case with Hungary’s Orban.

In 2017, Slovak government approved a milestone strategic document for bilateral economic cooperation, yet its action plan was not approved due to MFA’s skepticism towards the prospects of bilateral ties, manifesting the diverging views on cooperation with China among different actors. As a result, the proposed measures such as increasing the severely understaffed diplomatic personnel and overall diplomatic presence of Slovakia in China have remained on paper only, hindering a more effective Slovak China policy.

No magic wand

The case of Slovakia shows that BRI is only an empty overall outline that needs to be filled with specific cooperation content to have real meaning for bilateral relationship. Mere “subscription” to the initiative does not by itself bring any benefits. It is practically certain that Slovak-China cooperation would look the same even if Slovakia had not signed the BRI MoU. Rather than having actual meaning for bilateral cooperation, the joining of BRI is a symbolic act that promotes China’s prestige and its views of global development and thus predominantly serves China’s interests. It is obvious that China will not award preferential treatment to a country just because it subscribes to BRI, especially in the case of a marginal partner such as Slovakia.

This, of course, is not to say that Slovak-China cooperation does not have any potential. We will most likely see increased interest of Chinese investors towards Slovakia, with potential growth of green-field investments. We have already seen a surge of interest of Chinese companies to participate in public tenders. Yet, neither BRI nor, for that matter, 16+1, will be some kind of a magic wand that will make the existing obstacles to cooperation disappear. Realizing this fact should help Slovakia avoid both having unrealistic expectations but also become too sceptical and passive in case the desired progress is not achieved.

This blog is a part of the research project Comparative Analysis of the Approach towards China: V4+ and One Belt One Road (OBOR) supported by the International Visegrad Fund.