Germany is considering banning equipment made by Chinese companies like tech giant Huawei – in its 5G mobile infrastructure. A revised 2021 IT Security Act failed to reduce China’s 59 percent market share. A representative opinion poll, shows only 30.8 percent of Germans want 5G cooperation with China. Across 11 European countries, skepticism is equal, with only 31.8 percent approval – though this varies greatly from country to country.

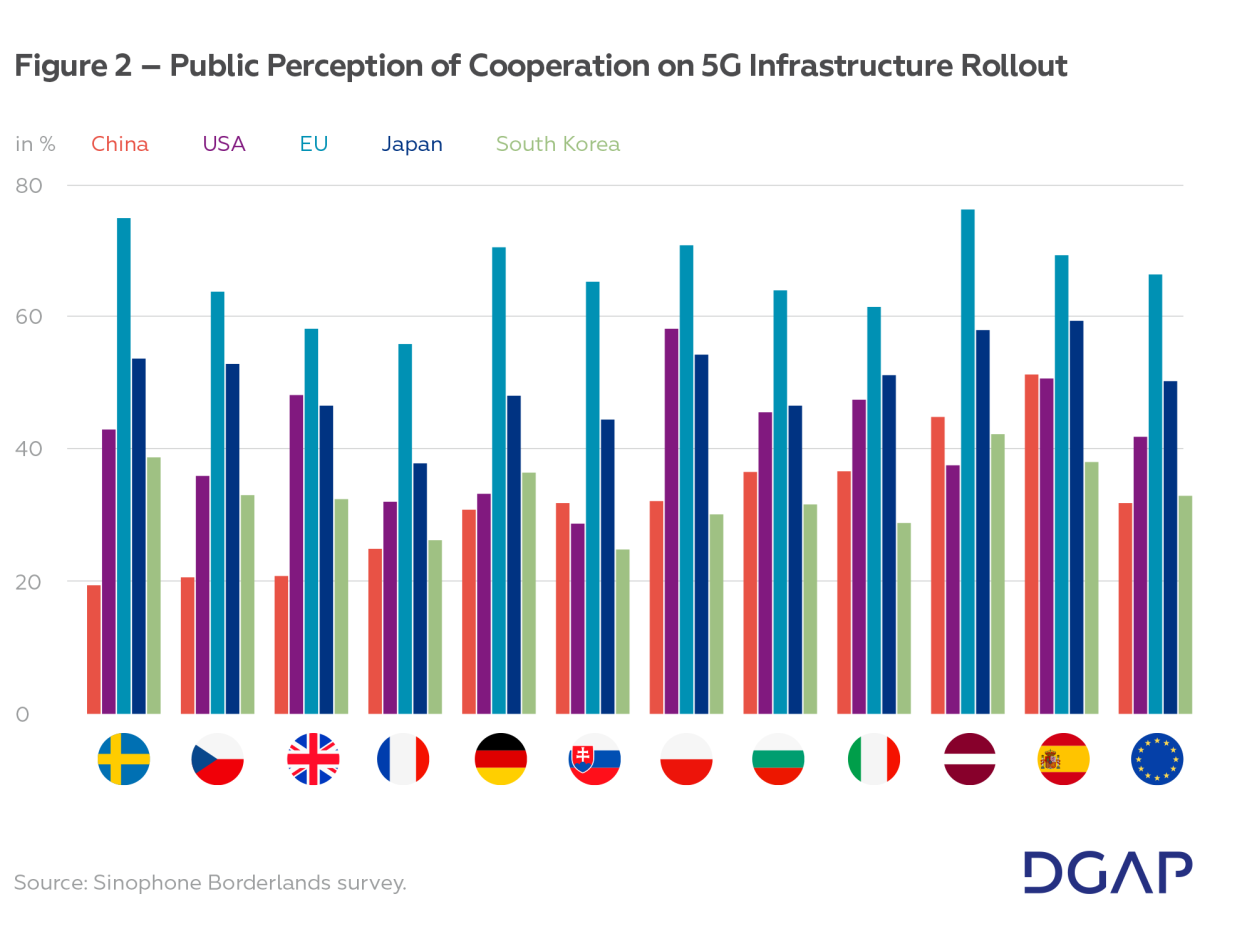

Approval for cooperation with Chinese vendors ranges from 19.4 percent in Sweden to 51.2 percent in Spain. In the middle are Czechia (20.6 percent), the United Kingdom (20.8 percent), France (24.9 percent), Slovakia (31.8 percent), Poland (32.1 percent), Hungary (36.5 percent), Italy (36.6 percent), and Latvia (44.8 percent).

Germans (70.4 percent) and Europeans (66.3 percent) support inner-European 5G cooperation. 50 percent or less approve tie-ups with Japan, the United States and South Korea.

Political distrust is the main reason for disapproval of cooperation with China. Potential economic losses and cybersecurity are of less importance.

German policymakers need to either reduce Huawei’s market share or explain to the public why cooperation with China is not politically harmful.

Only a few years after Europeans debated whether to include Chinese technology in their new 5G wireless infrastructure, the issue is back on Germany’s political agenda. Contrary to expectations when Germany adopted its revised IT Security Act in 2021, the market share of Chinese technology in Germany’s 5G infrastructure has remained stable. Now the Federal Ministry of the Interior has requested detailed disclosure from mobile operators of the vendors used for 5G infrastructure components, to assess the possibility of banning equipment from China. And just as in 2019-2021 when the issue came to a head across Europe, three sets of arguments are shaping the discussion – political, economic and technical:

The political viewpoint focuses on China as a geopolitical competitor of the West. Critics are concerned that being overly dependent on Chinese technology in a critical infrastructure makes Germany vulnerable to blackmail. In addition, there are ethical concerns. Chinese vendors are widely believed to be complicit in human rights violations in the People’s Republic of China (PRC). For these reasons, some advocate the full exclusion of Chinese vendors in 5G infrastructure.

Others are concerned that a ban could provoke economic costs such as those from technological adaptation (when mobile infrastructure is switched from Chinese to European technology) or the threat of retaliation. China’s ambassador to Germany, Ken Wu, has said publicly: “If Germany were to take a decision that leads to Huawei’s exclusion from the German market, you could expect consequences. The Chinese government will not stand idly by.” Seen from this viewpoint, Germany should not ban Chinese vendors.

A third perspective is technical, with two opposing conclusions. Critics of Chinese tech giant Huawei, which is a major global competitor in 5G infrastructure equipment, highlight cybersecurity concerns. They fear technical vulnerabilities could be exploited for sabotage and espionage. But proponents of cooperation with China argue that Huawei technology is the most advanced and reliable. Banning Chinese technology could put Germany’s own technological development at a disadvantage.

How much do these three perspectives resonate with the German and European public? Do views on political relations, economic dependencies or technical considerations shape what people think of including Chinese technology in our critical infrastructure? Are there great divergences across the continent or do Europeans largely agree?

This Policy Brief provides answers to these questions from a representative opinion poll in ten EU member states and the United Kingdom, including Germany. It provides separate evidence from German public opinion because Germany is currently assessing the security of legacy components in its 5G Radio Access Network (RAN). The RAN essentially consists of the base stations including their antennas that connect our devices to the network. The debate focuses largely on the RAN because it takes over more critical functionality in 5G compared to previous mobile network generations while its market is rather concentrated. In other words, there are comparatively few alternatives to Chinese vendors Huawei and ZTE. However, two large European suppliers exist, namely Sweden’s Ericsson and Finland’s Nokia.

Germany’s decision will have implications far beyond the country. Mobile infrastructure is highly interconnected and data flows do not stop at national borders. Hence, decision parameters in one country – especially a large member state in the center of Europe – affect decisions of other countries. This explains why the European Commission is insisting that EU member states do more to increase their network security. In June 2023, EU Internal Market Commissioner Thierry Breton said: “To date, only 10 of them have used these prerogatives to restrict or exclude high-risk vendors. This is too slow, and it poses a major security risk and exposes the Union’s collective security, since it creates a major dependency for the EU and serious vulnerabilities.”

Since Germany remains comparatively open to Chinese 5G components, it represents a significant outlier in Europe. One can speculate whether Germany’s disproportionate economic exposure has made it more reluctant to ban Chinese equipment. This brief specifically addresses whether the population privileges such economic concerns over political and technical considerations – unlike in other countries. We therefore compare public opinion data from Germany with that of others to examine whether the German public supports Germany’s exceptional openness.

A representative sample of 16,500 respondents across Europe (1,500 in each surveyed country) participated in the poll that was conducted in late 2020. At that time, the question of whether Huawei should be involved in the rollout of 5G infrastructure had gained widespread attention across the continent.

Public opinion is relevant because it is the normative aspiration of democracies to put the will of the people into practice. Europe and China are in a systemic rivalry. Living up to democratic values in Europe and implementing the will of the people is crucial for Europe to prevail. Meanwhile, democratic policymakers concerned about their reelection need to consider public preferences in practice. Policymakers are also socialized within the same “epistemic community,” hence they are themselves influenced by public sentiment (and can try to influence it, too) if they have a sense of what it might be. This Policy Brief provides the factual basis for such considerations.

The Public Opinion Survey: Materials and Methods

Public opinion data from 11 countries selected for this study come from a range of subregions in the European Union (and the UK) and are among the most influential in EU decision-making and in their respective regions. While not necessarily “representative” of Europe as a whole, we argue that this composition can grasp the diversity of European attitudes.

The survey data was collected online in September and October 2020 by a professional agency (NMS Market Research). The research sample in each country was 1,500 persons and was representative based on gender, age, region in the country, education level, and urban-rural divide.

The key dependent variable of our analysis was willingness to cooperate with companies from China (and also separately the US and the EU), measured by the seven-point Likert scale (disagree-agree). We then selected a number of independent variables representing three main arguments (all working with the similar seven-point Likert scale).

To investigate whether technical arguments resonated with the public, we considered how technologically advanced China was perceived to be and how much the respondents supported their country’s foreign policy priority towards China in addressing cybersecurity. To grasp economic considerations, respondents were asked how important China was for the development of their country’s economy and about their support for the foreign policy priority towards China in promoting trade and investments. Finally, we tested four variables to distinguish between the general political attitude towards China and foreign policy as a subset of political arguments in the European debate. For the former, the two variables asked about the level of trust towards China and the human rights situation, while for the latter respondents were asked about the assessment of Chinese foreign policy (negative-positive) and the extent of preference for their country’s foreign policy alignment with China.

To analyze data, we first tested correlations between the willingness to cooperate with Chinese (and separately also the US and EU) companies and each of the independent variables. This gave us a general idea of how closely each of the independent variables was aligned with the dependent one. Subsequently, we ran a regressive analysis for the models describing willingness to cooperate with the Chinese, US, and EU companies.

As this paper and the related survey focus primarily on China, we investigated fewer indicators with regard to 5G cooperation with the EU and the US.

Europe’s Divergent 5G Policy

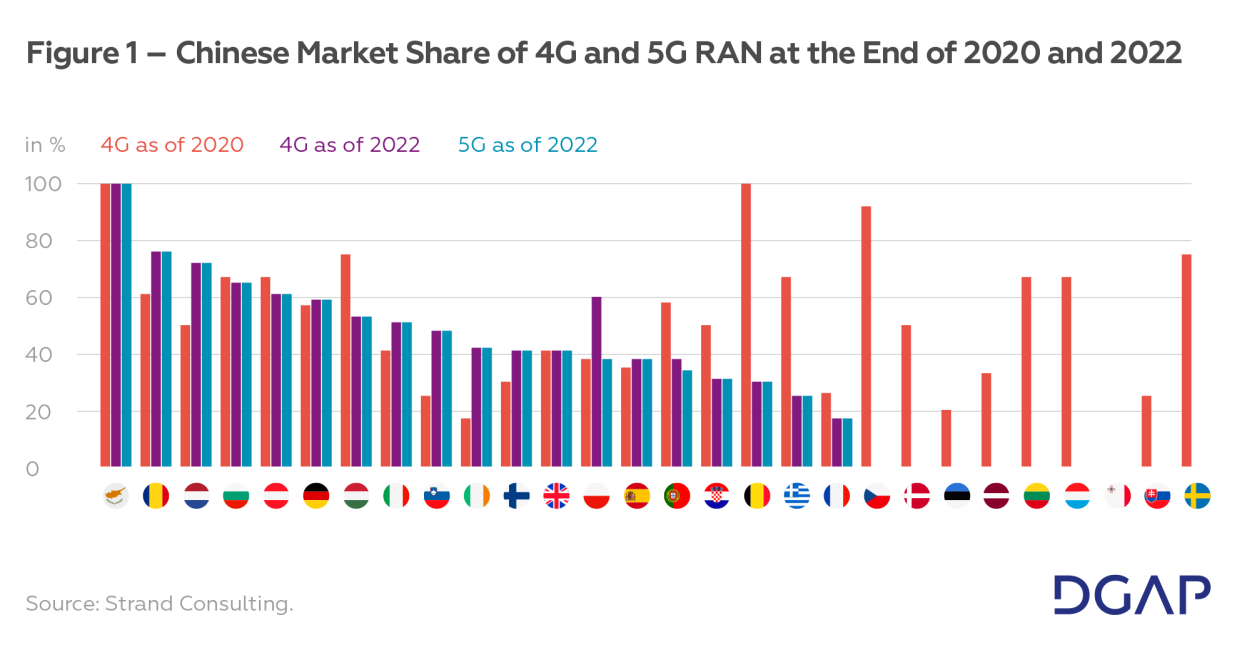

Despite attempts to find a unified European approach, which led to an “EU 5G toolbox,” EU member states (and the United Kingdom) have adopted different responses to security concerns about Chinese 5G equipment. Some states, but not all, took legislative or regulative action. Germany, for example, revised its IT Security Act. Even those that acted did not adopt the same instruments. As a result, the market share of Chinese vendors developed very differently across the continent (see Figure 1).

The chart illustrates that most European countries have reduced their market share of Chinese vendors in moving from 4G RAN to 5G RAN. Cyprus is the only country that is still fully committed to Chinese vendors. In some countries, Chinese RAN equipment was already replaced or reduced in 4G between 2020 and 2022. However, Chinese RAN market share in 5G still diverges greatly across the continent, ranging from 100 percent in Cyprus to a complete exclusion in the Czech Republic, Denmark, Estonia, Latvia, Lithuania, Luxembourg, Malta, Slovakia, and Sweden. In Germany, Chinese vendors still hold a market share of 59 percent, up by 1 percent compared to 4G in 2020. It is against this backdrop that Germany’s government is currently discussing whether to tighten regulation to reduce China’s market share.

Three Perspectives on China’s Role in 5G Infrastructure

The divergent European policy responses reflect a controversial discussion involving three sets of arguments for and against using Chinese vendors in 5G: Political arguments suggesting that Chinese suppliers should be excluded; economic arguments favoring the involvement of Chinese vendors; and technical arguments with points both in favor and against the inclusion of Chinese suppliers.

Political Viewpoints:

Many critics of China argue that technological (over-)dependencies on the People’s Republic of China (PRC), coupled with divergences in political values, carry enormous political risks. This is particularly critical due to a highly concentrated global RAN market. Limited competition in 5G RAN could lead to high dependency on Chinese tech giant Huawei. In the previous mobile RAN technology generation, several European states relied heavily – if not exclusively – on Chinese suppliers. The core challenge is that dependency does not end with the purchase because mobile infrastructure requires regular maintenance usually supplied by the vendor.

China’s critics see dependency risks as a major threat. In times of geopolitical tensions, they argue, dependency on the maintenance of critical digital infrastructure could be used to blackmail Europe and restrict the EU’s freedom to act. Europe and China are not in a security alliance and hold greatly diverging sets of values. Hence, the EU and the PRC could find themselves on different sides of a major conflict, not least if tensions in the Taiwan Strait escalate. Just as the dependency on energy supply from Russia has been weaponized in the Ukraine War, China could resort to similar tactics.

Huawei, the company at the center of the debate, has countered these political arguments with reminders that it is a privately owned company, not a political actor. However, analyses of the firm’s governance structure show that the owners do not necessarily exert control over the company. This fuels suspicion that China’s party-state ultimately controls Huawei. In addition, Article 7 of the PRC’s National Intelligence Law requires every organization and citizen to “support, assist in and cooperate in national intelligence work.” Based on these characteristics, the highly concentrated RAN market and the need for regular maintenance work, critics conclude that a high degree of technological dependency could make Europe vulnerable to political blackmail from China.

Economic Viewpoints:

Proponents of 5G cooperation between Europe and China put forward two economic arguments. First, advocates of cooperation with Chinese suppliers emphasize that the PRC has a self-interest in continued economic cooperation that requires it to be a reliable partner that delivers fail-safe technology. When the discussion began, Europe was an important export destination for Huawei. The company’s handset market share in Europe was around 20 percent in early 2020. Since then, its sales of new handsets have fallen dramatically to around 2 percent. It is precisely this reputational cost that some argue keeps China from exerting malign influence in Europe. In other words, undermining trust in Huawei’s products would not be in China’s interest because Huawei makes big profits in Europe, and this should keep Europe secure. China also continues to rely on imports from the West. In 2021, 53 percent of its imports worth no less than EUR 1.25 trillion came from the West. The PRC’s dependency is particularly high in key areas such as machinery, semiconductors, and food (meat, grain, etc.) and a few raw materials such as iron ore and gold.

Second, European industry sees potential negative impacts should Chinese technology be excluded from the rollout of 5G. Europe depends on the PRC economically and could suffer from Chinese economic coercion. Chinese goods account for 12.8 percent of all imports to Germany, for example. In the last ten years, 6-8 percent of German exports headed to China. China has demonstrated its willingness to economically coerce trade partners – for example, informal trade restrictions against Lithuania in recent years. Chinese government representatives in Europe, such as China’s ambassador to Germany, have been clear that PRC leaders would not ignore the exclusion of Chinese 5G technology from the European market.

In short, proponents of an economic viewpoint argue that it is in Europe and China’s mutual interest to cooperate technologically. The PRC relies on imports and exports from Europe. It has no interest in risking its reputation as a reliable technology supplier and would therefore abstain from malign actions against the EU. It is in Europe’s self-interest, on the other hand, to cooperate with China and prevent any economic retaliation or economic coercion.

Technical Viewpoints:

Finally, both proponents and critics of Huawei have used different technical arguments to justify their positions. Australian and US intelligence agencies (among others) warn of technical risks should Chinese technology be included in 5G infrastructure. They fear that Chinese equipment could enable China’s party-state to spy on users of the infrastructure (“espionage”) and shut down the mobile network entirely (“sabotage”). These concerns are well-grounded, but – as has been demonstrated elsewhere at length – it is not clear that excluding Chinese technology vendors is a viable solution. If a malign actor were to take control of the 5G network, it would affect almost all spheres of economic and social life. Because the most innovative technical features of 5G may enable a wide range of use cases – including self-driving cars or a new wave of production automation using mass machine-to-machine communication – these critics argue that espionage and sabotage are not marginal concerns but could paralyze entire societies. Whether such innovations will already materialize in 5G or only in the next generation of 6G mobile infrastructure expected around 2030, remains to be seen.

Regardless of the timing, such development requires highly innovative technology. Proponents of cooperation with China therefore point out that Chinese tech firm Huawei has been an innovation leader in the field. Excluding Huawei, they argue, could slow the rollout of 5G and hinder Europe’s technological advance.

European Public Opinion: Results From a Survey

Data from a representative public opinion survey across 11 European countries sheds light on what Europeans think about Chinese participation in their 5G infrastructure. First, we compare public opinion to the development of Chinese RAN market share as outlined above. We then test to what extent the three sets of arguments – political, economic and technical – shape public opinion.

At least 1,500 respondents participated in each country (for more on the sources and methods of the survey, see box 1). The survey was conducted in 2020 during the last days of the Trump administration, and it must at least be assumed that US approval ratings in Europe would be higher now since the general image of the US has improved under President Joe Biden. Unfortunately, no newer dataset of similar comprehension is available.

Comparison of Public Opinion and 5G Policy in 11 European Countries

The survey results demonstrate that, of all potential cooperation partners on 5G Core Network and 5G RAN technology, collaboration with the PRC receives the lowest approval at 31.8 percent, followed closely by South Korea (32.9 percent). Cooperation within the EU is most popular (66.3 percent). The US (41.8 percent) is well-behind Japan (50.2 percent). It is reasonable to assume, however, that approval for cooperation with the US would be higher now than when the survey was taken, since the Biden Administration is pursuing a more transatlantic-focused foreign policy. It is beyond the scope of this study to analyze why approval for cooperation with South Korea is so low and rates for cooperation with Japan rather high.

The general finding in Germany is in line with this. Support for cooperation with the PRC is lowest with 30.8 percent. This contrasts with approval rates of 70.5 percent for intra-European cooperation, followed by 48.1 percent for Japan, 36.4 percent for South Korea and 33.3 percent for the United States. Figure 2 demonstrates several commonalities and divergences across the surveyed countries. Intra-European cooperation receives the highest scores of more than 50 percent approval in all states. Support for cooperation with both China and the US varies significantly. China scores worst in five out of 11 countries. While in most surveyed countries, a bit less than one third of the respondents want to cooperate with the PRC, the results range from only 19.4 percent in Sweden to 51.2 percent in Spain. Strikingly, support or rejection of cooperation with either of the two great powers is not negatively correlated. We also find no clear regional patterns. While Nordic and Western European countries tend to be somewhat more critical of cooperation with China on 5G, we see significant divergences in Central and Eastern as well as Southern Europe.

Comparing government approaches with the survey results demonstrates that public opinion has not determined the policy differences across the 11 European states. In Sweden, Czechia and France, the low approval rate of cooperation with Chinese vendors matches a low market share and the significant reduction of China’s influence. A somewhat similar case might be made for Slovakia where the population is still somewhat skeptical at a time when Chinese equipment is being removed from mobile networks. In Hungary, one could argue that a somewhat skeptical public opinion is met with a significant reduction of the market share, but the absolute level remains high, which contrasts with public sentiment.

In other European countries, divergences between public opinion and the development on the ground are even sharper. The British public is particularly skeptical of cooperation with Chinese vendors, but the market share remains stable at above 40 percent. This might change, however, as the UK government has approved a ban on Huawei equipment. In Germany, skeptical public opinion contrasts with a high market share that has even slightly increased. In Poland, the majority of the population is skeptical while China’s market share in 4G RAN has even increased, and that of 5G RAN is at 38 percent. While the Italian public might be slightly more open to cooperation, a majority remains skeptical. This contrasts with a Chinese market share in Italy that has even increased to above 50 percent.

Latvia and Spain are quite the opposite. In both countries, the public is relatively open to cooperation with China. But in Spain, the market share has only increased slightly and remains below 40 percent. More striking is that Latvia, in contrast to public opinion, has effectively excluded Chinese equipment.

Which Arguments Resonate With the European Public?

What are the issues determining whether Europeans are open to 5G cooperation with China? In the following, we test the statistical impact of respondents’ perspectives on political, economic and technical issues against their approval of 5G cooperation. From this, we extrapolate the resonance of political, economic and technical arguments outlined above.

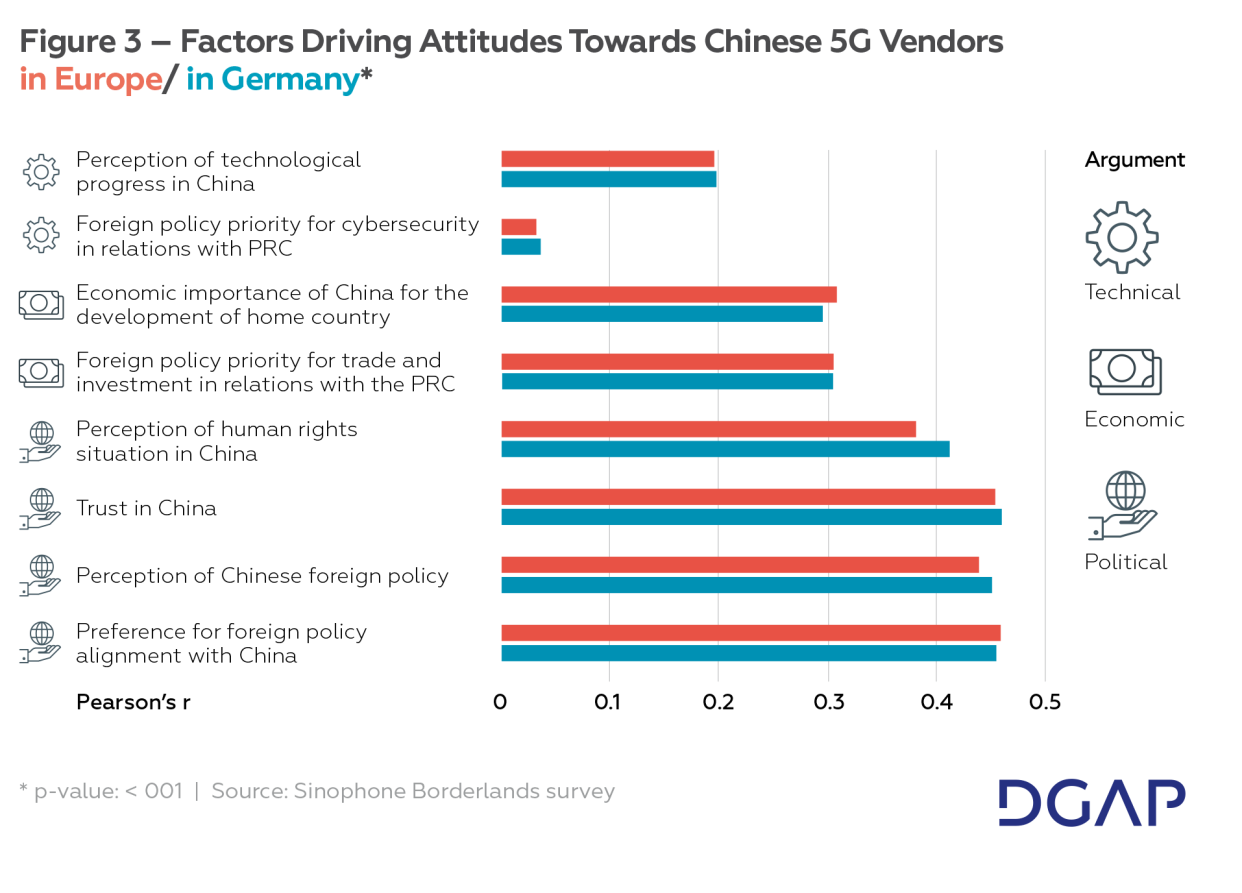

The results indicate that political factors resonate strongest among European respondents – in particular, concerns about foreign policy. Trust, foreign policy alignment, and the perception of China’s foreign policy correlate the strongest with the willingness to cooperate with Chinese firms on 5G; views on the human rights situation also correlate strongly.

The importance of China for the economic development of European countries and foreign policy preferences on trade and investment correlate somewhat less than political factors with opinions on 5G cooperation with PRC firms.

Perceptions of Chinese technological progress and concerns over cybersecurity in foreign policy show much weaker correlations, although still statistically significant (Figure 3).

These findings are largely consistent throughout all 11 individual countries. Political concerns resonate strongest in every single surveyed country, followed by economic and then technological arguments. This order of correlation is particularly strong in Sweden and the United Kingdom. In Hungary, Italy, Slovakia, and Spain, correlations of economic factors are stronger than in the European average, and political factors play a weaker role. However, even in these countries, political factors are more impactful than economic ones.

To test these findings, we ran a series of ordered logistic regression models. All models confirmed that political factors are the strongest predictors of a preference to cooperate with Chinese companies, ahead of economic factors, and with technical factors being the weakest (but still statistically significant) (see Annex, Regressions 1-3).

The German results are consistent with the overall findings from Europe. Figure 3 demonstrates that political arguments resonate even slightly stronger than the European average, with the exception of preference for foreign policy alignment with China which scores slightly lower. The regression 4 (see the Annex) is in line with this finding.

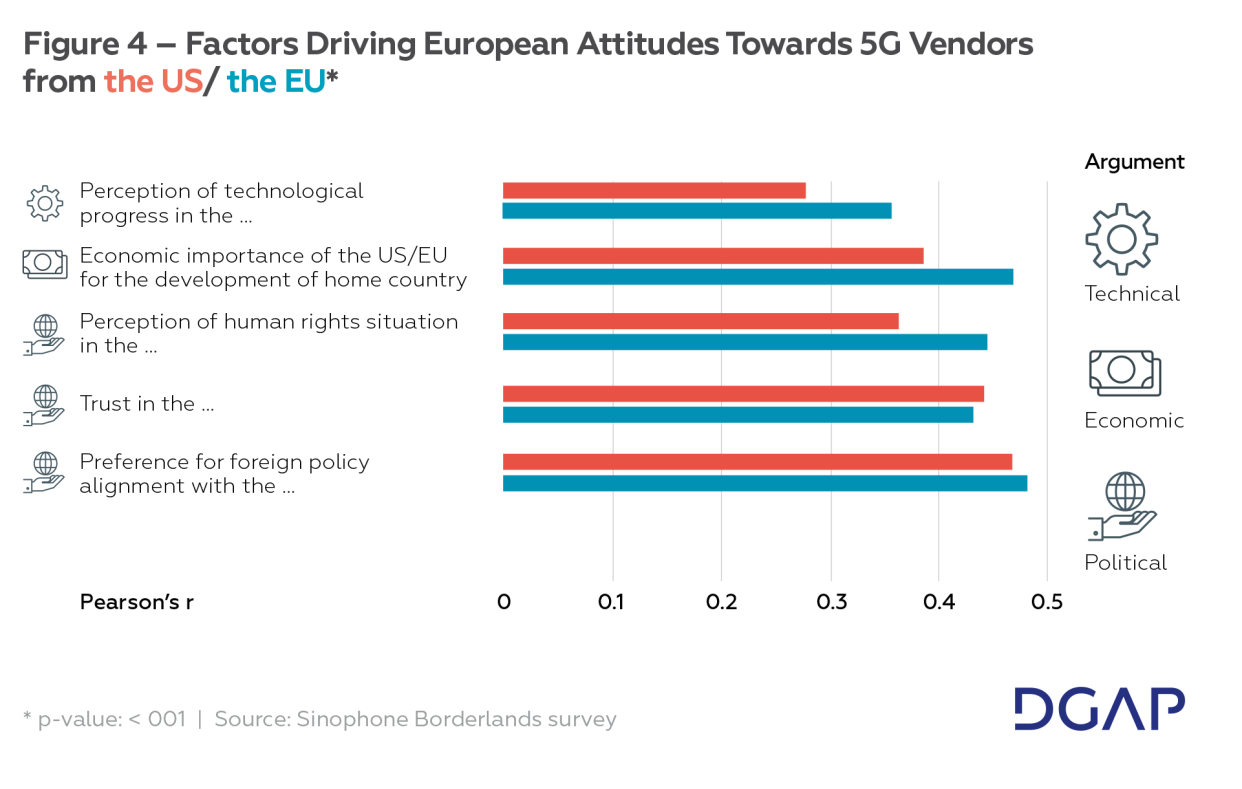

We also investigate whether similar findings explain Europeans’ perspectives on 5G cooperation with the US and with vendors from other European countries. We find similar, though not identical, correlations. While foreign policy alignment and trust in the US carry the strongest correlation with Europeans’ opinion on cooperation with the US on 5G, economic importance is more important than the perception of the human rights situation across the Atlantic. Perception of technological progress correlates the least (see Figure 4). The regression analysis confirms this finding (see Regression 5 in the Annex).

All factors correlate with support for cooperation on 5G with other EU member states. Again, technological progress is the weakest in terms of correlation. Economic importance, by contrast, ranks second and correlates more strongly than human rights and trust. Consistent with other findings, however, foreign policy alignment is the strongest (Figure 4). This also holds against a regression analysis (see Regression 6 in the Annex).

Conclusion and Recommendations

The question of whether Europe should include Chinese technology in the rollout of 5G has not only been the subject of international affairs but has attracted wide attention in EU member states. Democratically elected European governments need to take public opinion into account, while public opinion polls also serve as barometers of general sentiment, influencing policymakers. Based on an original representative survey, we demonstrate that cooperation with China receives the lowest approval among Europeans, albeit with differences across European societies. German public opinion is almost fully congruent with the European average. This shows that policymakers rather ignore public opinion as they keep the role of Chinese companies in the 5G sector at relatively high level. A comparison of the market shares of Chinese vendors in the surveyed countries and their development since 2020 illustrates that public opinion does not correlate with the divergences in different countries. Hence, public opinion seems to have not been the driving factor determining the 5G approaches of European leaders. This is particularly problematic because of the systemic rivalry between China’s authoritarianism and Europe’s democratic system. For Europe to prevail, legitimacy stems from an effective implementation of the will of the people.

Political considerations resonate the strongest with the European public, especially the assessment of Chinese foreign policy, ahead of general characteristics and values. Technological and economic considerations that have also been part of the European debate take a back seat.

As German policymakers are (re-)considering the involvement of Chinese vendors in the rollout of 5G infrastructure technology, there are several implications of this study they might want to consider.

First, the German public – just like other European societies – is skeptical of 5G cooperation with the PRC. This means the German government either needs to explain why it does not consider cooperation with Chinese vendors a risk or it should consider instruments to phase out Chinese suppliers. Merely continuing to cooperate amid rather high levels of concern would not find general support and could rather fuel distrust in the political class.

Second, as long as there are political tensions between China and Germany, approval for 5G cooperation with China is likely to remain low. Improvements in cybersecurity or further technological advances of Chinese vendors cannot meet the geopolitical and value concerns of the German and European public. If China were willing, as some observers believe, to broker a peace deal in Ukraine, public perception of political relations could change. But at the time of writing this appears unlikely.

Third, any potential improvement and deepening of economic relations will do little to fundamentally change European and German skepticism. Concerns over economic sacrifices have a relatively low impact on public opinion when it comes to cooperation with China on 5G technology. For example, even if the European Parliament were to ratify the currently frozen EU-China Comprehensive Agreement on Investments (CAI), which would deepen their economic cooperation, China can hardly expect this to make cooperation in digital technology more popular among the European public.

The paper was originally published by German Council on Foreign Relations. Image credit: IMAGO / Agencia EFE