A US-led tech blockade can only temporarily impact China’s tech development. The West must remain competitive by maintaining an equivalent research and development expense to China, regardless of export bans, or risk losing its substantial geopolitical and tech leverage.

Since the Netherlands joined the United States in imposing sanctions against China’s chip industry, the chorus has grown louder for the European Union to also take a more coordinated approach on a similar export ban. In January 2023, the US struck a three-way-agreement with the Netherlands and Japan on equipment exports to China, a clear sign that there will be more export controls on a global level. As more countries collaborate with the US in restricting high-tech exports, China risks losing its access to core technologies worldwide. The latest financial results of Huawei, one of the most innovative Chinese firms, are clear: the pain inflicted by US sanctions is real and is becoming increasingly apparent.

Huawei is an important example but it is only the tip of the iceberg in elevating strategic competition and geopolitical tensions. First, export bans are now more common than before, with no sign of being scaled back. Second, governments have stepped up their industrial policies to compete with each other. Both issues have important policy implications on whether the export ban is the correct or adequate tool to maintain a leading edge in technology, especially for the West.

Export bans can slow down China’s tech development in the short run

Because of a sharp fall in profits, Huawei is facing severe short-term challenges as it loses access to foreign chips, the technologies of which mainly originate in the West and US allies. The pressure may be evident in other Chinese firms in the future as the number of sanctioned entities continues to grow. In fact, Huawei has faced US sanctions since 2019 but the real impact has only been felt in more recent years. A key reason is that US sanctions were imposed on a step-by-step basis; the previous Trump administration was exploring its options and introducing measures in a relatively disorganized fashion.

Massive stockpiling of inventory meant many of the measures led by Washington came with grace periods with gray areas. For example, the US gave Huawei several 90-day extensions between May 2019 and May 2020, allowing American firms to continue selling to the Chinese manufacturer. Sales to Huawei as the end user and along its supply chain were only sanctioned from August 2020 onwards. US sanctions are now more streamlined and targeted, with a quicker implementation and fewer loopholes. As a result, Huawei’s net profit fell over the past two years by 13% in 2021 and 37% in 2022.

While the COVID-19 shock has damaged many sectors, the mobile communication industry has been less affected, so this is not a reason behind Huawei’s weaker performance. Between 2019 and 2022, Huawei saw a compound annual growth rate decline of 9%, while its competitors observed a rate of 4%. The impact of US sanctions is also evident in Huawei’s consumer business as the impact was severe on phone production. In November 2020, Huawei sold its budget-brand smartphone unit Honor to a consortium of buyers, including the Shenzhen government. Since then, its revenue from consumer business has fallen by 56% from its peak in 2020.

However, Huawei is not making a loss. The carrier business (mainly 5G infrastructure and optical networks) is still holding up. The enterprise business (cloud services and digital solutions) is rapidly growing due to the ever-growing trend in digitalization. Although Huawei faces a tech bottleneck in smartphone production, it remains a global leader in base stations, with an almost unchanged market share at around 30% between 2019 and 2022.

This indicates that export bans are only partially effective due to the lack of strength and/or coverage, or the punitive tool alone is not sufficient for the West to compete with China. Huawei still manages to replace some US suppliers even though it carries a risk of weaker performance. For instance, Huawei claims to have had breakthroughs in electronic design automation (EDA) tools for chips above 14 nanometers. Ren Zhengfei, the founder, also said it replaced more than 13,000 components with domestic substitutes and redesigned over 4,000 circuit boards after the US sanctions. It is hard to confirm whether the claims made by Huawei are wholly accurate from a technical perspective, but the bottom line is the firm continues to invest in its supply chains and manage to replace some components for which it relied on Western companies.

The West needs to match China’s R&D expenses to stay competitive

While export bans can effectively slow down Chinese firms by restricting their access to the West’s home markets and technology, it depends on whether there are alternatives and if the options are competitive enough in the long run. For the West to stay at the top of the tech curve, research and development (R&D) investment is the most crucial factor, with or without export bans.

On a country level, the US remains the top R&D spender globally. However, China at least doubled its R&D investment between 2012 and 2021. That implies China has surpassed the EU in its R&D spending both in nominal value and as percentage of GDP since 2021. China’s share of R&D expense to GDP rose from 1.98% in 2012 to 2.44% in 2021, and it further surged to 2.55% in 2022, according to preliminary figures released by the National Bureau of Statistics. In contrast, the EU only saw an increase from 1.96% in 2012 to 2.15% in 2021, according to the latest data available.

Regarding the digital communication industry on a corporate level, Huawei, Nokia, and Ericsson are the leading market players. Among the three firms, it is not hard to see why China is leading in market share. Huawei spent $24 billion on R&D in 2022, 5.4 times higher than in 2012. As a percentage of revenue, its R&D expenditure increased from 14% to 25% during the same period. It is not expected to scale back its investments in the coming years, especially after US sanctions. By comparison, Nokia and Ericsson only invest around $5 billion annually, equivalent to around 20% of their revenue.

The number of patent applications also reflects the difference in their R&D investment. Taking the European Patent Office as an example, China may not be comparable to the West in all sectors, but its digital communication patent applications are as much as the US. Together with the focus on computer technology, it shows clearly that China has a strong focus on the tech sector, which is relevant in its self-sufficiency push. On a corporate level, Huawei was the top applicant in three out of four years between 2019 and 2022. The number of patent applications by Huawei is also larger than by Nokia and Ericsson, combined.

The result is China is able file an increasingly high proportion of patents in Europe, bring its share to total from 1.4% in 2013 to 7.2% in 2022, surpassing South Korea since 2021. While it is arguable that the quantity of patents doesn’t necessarily indicate their quality, it still reflects China’s growing role in the sector, and investment is one of the critical factors. Huawei is now striking more deals in licensing its intellectual property: it has received more patent royalties than it has paid other firms since 2021.

Beyond investment, it is difficult for the West to compete with China’s growing sphere of influence in the Global South or the Belt and Road (BRI) countries in Beijing’s narrative, unless it offers the right products and solutions. It is unsurprising to see Huawei’s greater reliance on its domestic market. Still, the geographic revenue breakdown also shows the Europe, the Middle East and Africa (EMEA) region is relatively resilient compared to other markets. While there is no public information on further distinguishing the above-mentioned areas, it’s likely that much of the growth comes from the Middle East and Africa.

Indeed, Huawei has participated in building 5G networks in most Gulf states. A memorandum of understanding (MOU) was signed between Huawei and Saudi Arabia for technology in cloud computing and building high-tech complexes in December 2022, followed by an agreement with Saudi Telecom Company during the Mobile World Congress (MWC) 2023. African telecom operators are also heavily reliant on China’s telecom equipment and infrastructure.

What next?

Huawei’s experience clearly shows the power of US sanctions and export bans, and the impact can multiply if more countries agree to follow the US in the implementation of these. However, the effect can also be short-lived if China eventually moves up the tech ladder through heavy investment, either from corporations or government subsidies. Huawei is leading the way in building a domestic supply chain to reduce its dependence on the US and its allies for certain technologies and component parts, even though it can be extremely costly because of uncertainty about time it would take to achieve meaningful outcomes.

Ongoing geopolitical tensions and competition will encourage more bifurcated global supply chains. China will continue investing to achieve self-sufficiency and reach its Standards 2035 goal, which likely depends on its large domestic sales and facilitating exports to other markets. The threat of losing access to key technologies could fuel China’s “Sputnik moment”, compelling it to focus even more on innovation.

If the West solely relies on export restrictions, the risk is that these measures may only work temporarily and that China could overtake it in tech advancement and the setting of global standards. It is also uncertain whether BRI countries, especially those in the Middle East and Africa, will echo the West’s call to restrict China’s tech and products. As such, the West must remain competitive through better products and by maintaining an equivalent R&D expense to China, regardless of export bans, or risks losing its substantial geopolitical and tech leverage.

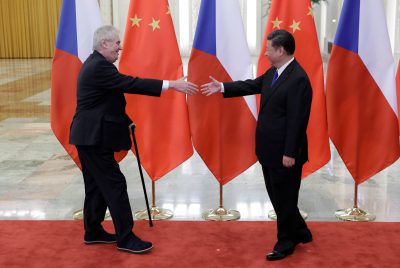

Cover photo: Wikimedia/X-SHLIED, CC BY-SA 4.0